How to Budget as a Student: Guide, Planner and Examples

Managing your money isn’t always easy at uni. For many students, it’s the first time handling their own finances. As a result, it can feel intimidating when you’re given a student loan for the first time. Pro tip: Don’t spend it all at once!

What should I be spending my money on? Will I have enough left over to last me the entire term? What will happen if I run out?

These are very common (and valid!) questions you may have about your finances. But you’re in the right place: in this blog post, you’ll learn all about how to budget as a student. Get an insight into common incomings, outgoings and how you can strategically manage your money, so your bank balance stays healthy even at the end of your loan payment!

Avoid money worries and overdrafts with our student budget guide. You’ll also discover tools you can use, places to go for support, plus our top tips.

Why You Need a Student Budget

When you’re at uni, you’ll probably have more responsibilities than ever before. That includes making sure your rent and bills are paid on time. Managing your budget is crucial if you need to make payments like these. Otherwise, you may run into trouble with your landlord or energy providers which, trust us, you don’t want!

That doesn’t mean you have to count your pennies every day, or stay in every night to save up. It’s just a good idea to keep an eye on where your money is coming from and going to. This way, you can feel more confident in how much you have left to spend, so you can enjoy yourself without having to worry about breaking the bank.

But if you do want to save up for something - travelling abroad, or a new laptop for example - that’s when a budget is super handy. Essentially, it helps you become more aware of your finances, so you can make more informed choices about what you’re willing to spend.

No matter whether you want to buy the latest games console, treat yourself to a brand-new outfit, or splash out on drinks (no judgement here!), a budget can take the stress out of these purchases.

Benefits of Budgeting

It Sets You Up for the Future

One of the main benefits of budgeting as a student is that it sets you up for future success. If you take out payday loans, you’ll be paying them off far into the future. But, if you budget effectively, you’ll be more likely to avoid going into debt.

With less debt, you can save for buying a house, going travelling, or any big purchases you want to make. Budget now to help future you!

Avoid Stress

Money worries are a big cause of stress for some students. And stress can have a big impact on your overall physical and mental health.

If you budget, you’ll feel more in control of your finances. It means you won’t be in the dark about where your money is going, and you’ll feel more confident that you have enough to last you until your next pay cheque and/or student finance payment.

Gain Financial Literacy

Budgeting isn’t just important when you’re a student. It’s a valuable life lesson that will help you throughout your life. If you learn more about how to budget now, you’ll be better prepared to make future financial decisions, like saving for a mortgage, having children or starting your own business.

How to Budget as a Student (With Example)

If you’re a uni student, it’s a good idea to have a weekly budget. This means you can keep on top of your finances on a more granular level, rather than checking in every month or term.

Here’s how to plan your weekly student budget:

1. Work Out Your Incomings

First, you need to understand what money will be coming into your account throughout the year.

Sources of income can include:

- Student loan

- Pay cheque from part-time job

- Savings

- Grants, bursaries or scholarships

- Money from parents/guardians

Incomings can be unpredictable sometimes. For example, if you have a zero-hour contract, money from a part-time job may fluctuate month to month.

Still, try and predict as best you can how much money you’ll have to spend.

2. Work Out Your Outgoings

Next, work out how much money will be leaving your account throughout the year.

This can include:

Essentials

- Course fees

- Rent

- Gas/electric

- Wi-Fi

- Water

- Mobile phone contract

- Insurance

- Food

- Toiletries

- Public transport

- Fuel

- Car insurance

Focus on the essentials as part of this budgeting exercise, but you can also include the following if you wish.

Non-Essentials

- Gym membership

- Streaming services (e.g. Netflix)

- Music subscription (e.g. Spotify)

- Nights out

- Eating out

- Hobbies

- Social events (e.g. cinema)

- Haircut

- Beauty (e.g. makeup)

- Clothes

- Other purchases (e.g. books)

3. Calculate Your Weekly Budget

Now you have your incomings and outgoings, you can work out your weekly budget using a simple formula:

(Incomings - Outgoings) ÷ No. of Weeks

This will tell you how much money you have left to spend on non-essential items (and enjoying yourself!) each week.

Student Budget Example

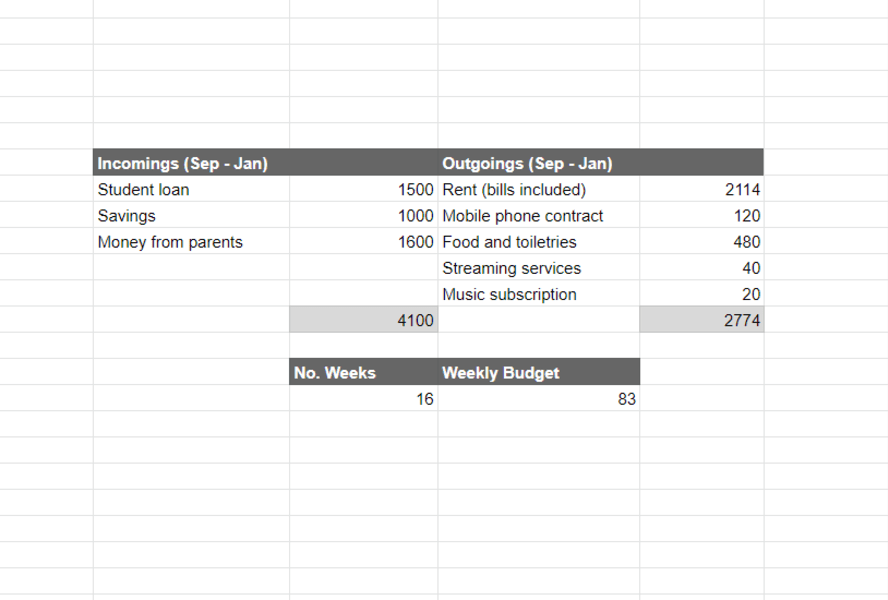

John is starting uni in September and wants to create a budget.

Using the process above, here is an example of what his student budget looks like.

His incomings and outgoings are for the entire term - the time between his first and second student loan payments. He has a combination of student loan, savings and money from his parents.

He lives in a true student apartment for £134 per week (bills included), and has other regular outgoings like a phone contract and streaming service payments.

After using the formula outlined above, we can see he has £83 to spend per week.

If he wanted to increase this budget, or work towards a savings goal, he could get a part time job or apply for a scholarship, for example, to top this up.

Tools to Help You Budget

Working out your budget is pretty simple. What’s more difficult is keeping track of it and recording your progress over time.

There’s no need to check your balance every day. This may only lead to you worrying about money when you don’t need to. However, if you get into the habit of checking how much you’re spending every week or fortnight, you’ll have a better idea of whether you’re on target.

There are lots of tools and methods to keep on top of your budget, such as:

Budgeting Apps

There is a wide selection of apps available to help you keep track of your spending and reach your financial goals, such as:

Student Budget Calculators

If you’d like more help calculating your budget, the UCAS student budget calculator is super useful.

It’ll help you work out the cost of living at uni for the specific university you’re going to. Just search for your university to get started, or view the full list if you’ve not made your mind up yet.

Student Budget Spreadsheet

Creating a spreadsheet is another great way to stay on top of your student budget. The formulas we used in the earlier example are:

- = SUM(All Cells With Incomings)

- = SUM(All Cells With Outgoings)

- = SUM((Total Incomings - Total Outgoings)/No. Weeks)

You can set up a Google Sheet or Excel with these formulas in under 10 minutes (no spreadsheet headaches required!).

Top Tips for Budgeting as a Student

As well as calculating your budget, there are lots of other ways you can make your money stretch further at uni.

1. Use Student Discounts (But Be Careful)

As a student, you can get lots of discounts on food, clothes and electricals, amongst other things.

UNiDAYS and Totem are two of the most popular options, which give you discounts on ASOS, Co-Op, Pretty Little Thing and more.

Be careful, though: just because a shop has a student discount, doesn’t mean you can’t find it cheaper elsewhere. It’s easy to be tempted by a deal, but make sure to do your research before splashing the cash on new items.

2. Buy Second Hand

For some courses, you’ll need lots of expensive textbooks in order to do the required reading.

If you’re studying something like English Literature, this can add up to hundreds of pounds each year, so it’s important to stay savvy when buying them.

One way to save money is to buy second hand. Your course may have a Facebook group where people sell on old books, or you might be able to find used copies on Amazon.

Not only is this useful for books, you can also find second hand furniture and clothes instead of buying them new. Facebook marketplace and Depop are great places to find deals.

What’s more, by recycling old items, you’re being more sustainable - making your wallet and the planet happy at the same time.

3. Apply for Scholarships and Grants

Your uni may offer scholarships, grants and bursaries that you’re eligible to apply for.

For example, some universities will provide grants to students from underrepresented backgrounds.

Check your university’s website to see if you can apply for any of these schemes. They can add hundreds, if not thousands of pounds to your income each year.

4. Use Cash Instead of Card

If you’re worried about going over your budget each week, using cash can be a good alternative.

Now contactless payments are the norm, it’s easy to spend money without realising how much is coming out of your bank account. By using cash, you have a better idea of exactly how much you have to spend.

If you have a budget of £80 per week, go to a cash machine on Monday and take this out, so you don’t go overboard with your spending.

5. Have Separate Bank Accounts

A similar idea to the above is to have separate bank accounts for different purposes.

For example, you could have one account that’s for rent and bills, and another for day-to-day spending.

This way, you can better keep track of what you have left over for the rest of the term.

To advance this further, you could set up standing orders. If you know you have a budget of £83 per week, set up a standing order to go into your ‘spending’ account, so it comes in automatically.

6. Splurge Before You Get Your Next Loan

Once your student finance loan comes in, it’s tempting to splash out on new clothes or electronics. But you need to make sure your money lasts you throughout the entire term.

To avoid money worries before your next payment, save your splurges to just before you next get paid. That way, you can be confident you’ll have enough money to pay your rent and bills before your next instalment.

7. Get a Railcard

If you travel a lot, a student 16-25 railcard can be a good investment. You can save on any journey you make which, if you use the train to commute to uni, can add up to hundreds of pounds every year.

8. Be Smart With Meal Prep

Food can be a huge drain on your finances if you don’t plan effectively. It can lead to lots of food waste and, as a result, money down the drain.

By planning your meals in advance, then building your shopping list around this, you can save money on your food shop. That’s because you’ll only buy what you need, and won’t have anything left over that goes out of date.

Where to Find Financial Support

Budgeting your money can feel overwhelming. It’s a lot of responsibility and, if done wrong, can lead to debt and other financial problems.

However, there are lots of places to go for support if you need any help.

One port of call is your family. Talking about money can feel awkward, but there’s nothing to be embarrassed about. They will have more experience in managing their finances, so they’ll be able to help you put together a plan.

Other places to turn to include your university or students union. These days, most unis have a dedicated team that will be able to help provide advice, or they may offer emergency funds if you’re really struggling.

What we don’t recommend is getting a payday loan. These have a high amount of interest, so you’ll be losing even more money in the long-term.

true student accommodation

We hope you found this student budgeting guide useful! Now, you have more knowledge and tools to help you better manage your finances, meaning you can feel more confident knowing you’ll have enough money to last you the entire term.

true offers student accommodation in locations including Birmingham, Glasgow, Newcastle, Liverpool, Salford and Swansea. Bills are included in the price of your rent, so you don’t have to worry about sorting direct debits and finances with your energy and water providers.